In Indian corporate jurisprudence, a company is established as a separate legal entity distinct from its members. This creation and its subsequent governance are meticulously regulated by the Companies Act, 2013. The Act mandates that every company must have two fundamental constitutional documents: the Memorandum of Association (MOA) and the Articles of Association (AOA).

While these documents are filed simultaneously with the Registrar of Companies (ROC) during incorporation, they serve distinct and critical purposes. For directors, shareholders, and investors, understanding the difference is not a matter of academic interest but a practical necessity for ensuring legal compliance and smooth operation.

This article provides a detailed analysis of the MOA and AOA under the Indian legal framework, highlighting their contents, legal effects, and interplay.

1: The Memorandum of Association (MOA) – The Company’s Charter

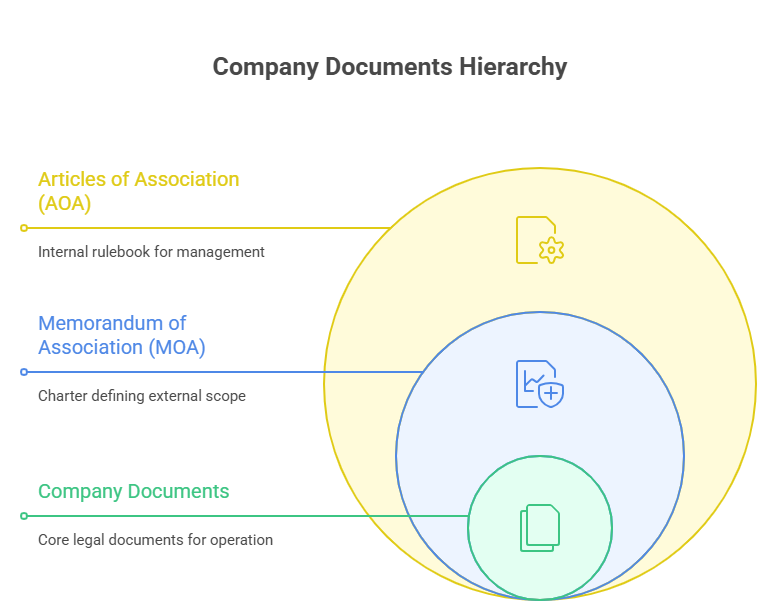

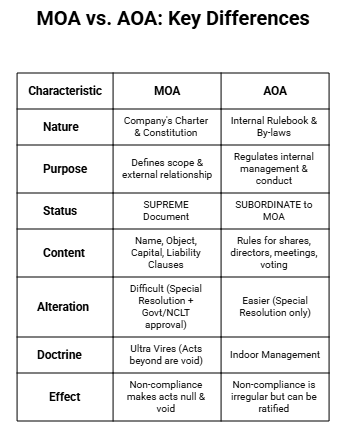

The Memorandum of Association is the supreme document of a company. It defines the company’s fundamental conditions and its relationship with the outside world. It is often called the company’s charter or constitution due to its overriding importance.

1.1 Legal Function and Nature

The primary legal function of the MOA is to define and limit the company’s powers and field of operation. It informs the shareholders, creditors, and all persons dealing with the company about the permitted scope of its activities. A company cannot legally undertake any activity that falls outside the objectives stated in its MOA.

This principle is enshrined in the famous doctrine of Ultra Vires (beyond powers). Any act performed by the company that is beyond the objects stated in its MOA is considered ultra vires and void. Such contracts cannot be ratified even by a unanimous vote of the shareholders.

1.2 Clauses of the Memorandum (Section 4 of the Companies Act, 2013)

The MOA of a company must be in one of the forms specified in Tables A to E in Schedule I of the Act, depending on the type of company. It must contain the following mandatory clauses:

Name Clause: States the name of the company with “Limited” (for public companies) or “Private Limited” (for private companies) as the suffix.

Registered Office Clause: Specifies the state in India where the company’s registered office will be situated. This determines the ROC’s jurisdiction.

Object Clause: This is the most critical clause. It outlines the main objects for which the company is established, along with other incidental or ancillary objects. The company can only pursue activities listed here.

Liability Clause: States whether the liability of the members is limited by shares or by guarantee.

Capital Clause: For companies with share capital, this clause specifies the authorised share capital and its division into shares of a fixed amount.

Subscription Clause: Contains the names, addresses, and occupations of the subscribers (first shareholders) who agree to form the company and to take at least one share each. It must be duly signed by them.

1.3 Alteration of the Memorandum

Altering the MOA is a serious affair and requires a Special Resolution (a resolution passed by a majority of not less than 75% of the votes cast) at a general meeting. Furthermore, certain alterations, such as a change in the object clause or the registered office from one state to another, also require approval from the Central Government or the National Company Law Tribunal (NCLT), as applicable (Sections 13 and 14).

2: The Articles of Association (AOA) – The Company’s Rulebook

If the MOA is the charter, the Articles of Association are the internal rulebook or by-laws for the company’s management. They govern the internal conduct and procedures of the company.

2.1 Legal Function and Nature

The AOA outlines the rules and regulations for the internal management of the company. They establish the contract between the company and its members and between the members themselves, defining their respective rights, duties, and powers.

While the MOA sets the boundaries of the company’s powers, the AOA details how those powers are to be exercised. Acting beyond the AOA is considered ultra vires the articles, but such acts can often be ratified by the shareholders.

2.2 Content of the Articles (Section 5)

The AOA contains rules on matters such as:

Share Capital and Variation of Rights: Different classes of shares, rights attached to them, procedures for issuing, transferring, and transmitting shares.

Lien on Shares: The company’s right to claim a lien over shares for unpaid debts.

Calls on Shares: Procedures for making calls (demands for payment) on shares.

Forfeiture of Shares: Rules for forfeiting shares for non-payment of calls.

Directors: Their appointment, remuneration, qualifications, powers, duties, and proceedings of Board meetings.

General Meetings: Notice periods, quorum, voting rights, proxy voting, and procedures for conducting shareholder meetings.

Dividends and Reserves: Procedures for declaring dividends and maintaining reserves.

Winding Up: Procedures to be followed in the event of the company’s winding up.

2.3 Model Articles and Table F

The Companies Act, 2013 provides Model Articles in Table F of Schedule I. These serve as a standard set of rules. A public company limited by shares can adopt these model articles in full. However, most companies, especially private ones, prepare their own customized AOA to suit their specific needs. If a company does not register its own AOA, the model articles applicable to its type will automatically apply.

The Doctrine of Ultra Vires: An act beyond the MOA is void. An act that is within the MOA but contrary to the AOA is merely irregular and can be ratified by the shareholders.

The Doctrine of Constructive Notice: Every person dealing with the company is presumed to have read its MOA and AOA, which are public documents. They are deemed to have notice of their contents.

The Doctrine of Indoor Management (Turquand Rule): This doctrine protects outsiders dealing with the company. While they are presumed to know the contents of the MOA and AOA, they are entitled to assume that the internal procedures required by the AOA have been properly followed.

Frequently Asked Questions (FAQs)

1. Which document is supreme, the MOA or the AOA?

The Memorandum of Association (MOA) is the supreme document. The Articles of Association (AOA) must always be consistent with the MOA. If there is a conflict between a provision in the AOA and a provision in the MOA, the MOA will prevail, and the conflicting clause in the AOA will be considered void.

2. Can a company change its Object Clause?

Yes, but the process is stringent. A company can change its object clause by passing a Special Resolution at a general meeting. However, as per Section 13 of the Companies Act, 2013, such an alteration must be confirmed by a Special Resolution and, in some cases, may also require an application to the National Company Law Tribunal (NCLT).

3. What happens if a company acts beyond its MOA?

Any act falling outside the object clause of the MOA is ultra vires and null and void. It cannot be enforced or ratified by the company or the other contracting party. The assets of the company cannot be used for an ultra vires act.

4. Is it compulsory for a private company to have its own AOA?

No. If a private company does not register its own Articles, the relevant model articles (or the applicable Table in Schedule I) will apply by default. However, most private companies create custom AOA to address specific shareholder agreements, transfer restrictions, and other unique governance needs.

5. How can the AOA be altered?

The Articles of Association can be altered by passing a Special Resolution (requiring a 75% majority) of the shareholders at a general meeting. The altered AOA must be filed with the Registrar of Companies (ROC) within a specified time frame.

6. Does the Doctrine of Ultra Vires still have significance under the 2013 Act?

Yes, it remains a cornerstone principle. However, the 2013 Act, like its predecessor, provides certain exceptions to protect innocent third parties who are unaware that the company is acting ultra vires.

Avinash Jaiswal is the Founder of Vidya Planet, is dedicated to improving the quality of learning through structured, clear, and authentic educational content. His work reflects a consistent effort to simplify academic concepts and present them in a way that supports meaningful understanding.